What if you were part of a group of women producing flowers to make a living, and you could invest in a solar-powered cold storage facility? It would double your income, simply because you would sell more flower petals for ceremonies at a temple, as they stay longer with low temperatures.

Now, imagine you are a member of a group of four farmers, producing mango, banana or guava, earning hand-to-mouth, barely sufficient to provide for your family. What if you could invest together in a solar-powered drying machine, so part of all your produce could be dried and sold later in the season, or sold for a higher price to shops in nearby villages and cities?

More income means more food and due to better food, your kids can concentrate better at school, or perhaps you can even save for times of bad health. Using solar power means: better for the environment (avoiding pollution) than for example using a diesel engine, and being less dependent on the electricity grid - if there is any. And above all: the sun is for free! Sounds like a good plan?

But...

There's nobody around who wants to lend you the money, because you are part of a community which is poor and has no collateral. And the solar-power technology is too expensive to be paid for with a individual micro credit. Moreover, there's no information availalable on how such a solar-powered cold storage or drying machine works. And above all, there is nobody who believes in you being able to make this work. Now, here is something new for you:

WE DO!

We are Kula Loans International, "Kula" in Sanskrit means "community of the heart". At Kula Loans International we dare to take the risk to provide loans to groups, willing to invest in solutions which will be beneficial to all members of the group, their families and the well-being of their larger communities. Imagine, others will get familiar with solar powered techniques, and more and more groups will try to increase their income through enterprises like the ones described: a solar powered rickshaw to bring produce to the market, solar powered irrigation, as well as repair shops becoming viable opportunities. Kula Loans International is a foundation that invests in groups of people that want to implement solutions that foster the well-being of their communities.

Kula Loans was founded in 2018 and is based in The Netherlands. We believe that the power of true transformation lies within any community. We also believe communal well-being to be the cornerstone of a thriving society. While traditional microcredit provides small loans to individuals with household businesses, Kula Loans aims at broadening the possibilities by reaching out to groups, and through group enterprises to the entire community. We are providing our loans via local partners.

We cooperate with local partners that share our vision and work according to the following key operational values:

Read more on policies in our mid-term strategic plan:

2022 - 2025 Mid-term strategic plan Kula Loans International

Consisting of a small board and a number of volunteers, Kula Loans International organizational structure is fairly uncomplicated.

Denise Schelbergen, managing director

Denise is the Managing Director of Kula Loans and started our community projects in Colombia (2019). She is the founder of Australian coaching and consulting business The Ikigai Entrepreneur, co-author of "Goodbye Busy, Hello Happy" (2022) and proud mom of her beautiful son Luca. Denise is committed to ending poverty in the world and empower people to create a life they love.

Viola Huenges Wajer, General Manager (Ad Interim) / Comms manager C4C

Viola Huenges Wajer, Ad Interim General Manager for Kula Loans and Comms Manager for C4C, joined the team in 2023. Having worked in a corporate/commercial environment for over 15 yrs, Viola was looking for voluntary work in which she could apply her learnings for a better cause. Inspired by the work done together with the Access to Care team in Philips, Sustainability and Access to Equitable Healthcare and Wellbeing have become topics close to her heart.

Erlijn Sie, chairperson

Erlijn is co-founder of Microcredit for Mothers, a foundation aiming to support women in Asia to set up their own business through small loans, provide the opportunity to save and get professional, entrepreneurial and leadership trainings. Currently the revolving fund provides loans to (over) 5000 families per year, in 8 different countries. She has been leading the Banking with the Poor network, and is author of the book "Reimagining Financial Inclusion" (2021).

Rene Pieterse, treasurer/fundraiser

In 2018 René had the time and energy to join Erlijn and Niels with the start of a social enterprise, out of curiosity: what does it take to get personally involved (or not) with charity? Learned a lot and getting/feeling more involved every day. Started as treasurer, now also as fundraiser. 30 years of business (IT) consultant experience has landed on fertile ground.

Giannina Pacheco, Program Manager Colombia

Since Giannina joined Kula loans she has been enjoying the journey of learning how the provision of loans can make a positive and sustainable impact to the lives of remote and disadvantaged communities in Colombia and worldwide. Volunteering is her way to give back to the community. With skills in business analysis, data and project management she supports Kula Loans Colombia partner through regular meetings and tracking of microcredits allocated to La Guajira communities in Colombia. Aside from working and volunteering, Giannina also loves travelling, interior design, plants, running... anything that inspires her creativity.

Jolinde Segeren, Program Manager

Jolinde Segeren, Program Manager at Kula Loans, brings over two decades of experience in financial inclusion and micro-finance, with a focus on empowering marginalized women communities in South and Southeast Asia. Dedicated to fostering connections and advancing business endeavors, Jolinde prioritizes partner relationships, optimizing outcomes, and forging new collaborations. She is committed to inspiring underprivileged communities.

Ingeborg Kempers, Program Manager Bangladesh / Ad Interim Program Manager Colombia

Ingeborg has 5 years of experience with microfinance and collaborates with various NGOs in Bangladesh. She is eager to contribute and make an impact on communities facing challenges. Ingeborg has a passion for Asia, engaging with different cultures, hiking, and sailing. Currently, she works as a controller and project coordinator at STEP, an organization that assists migrants and refugees in learning the Dutch language and integrating into society. Once again, she finds herself immersed in a diverse array of cultures representing 80 different countries.

Anna Kozminska, Program Manager India - NEED

Anna joined Kula Loans in 2023 as Program Manager for partner NEED in India. She has an extensive experience in various marketing roles and on a side teaches yoga. She is passionate about India and improving lives of others, constantly aiming towards making the world a better place.

Siddharth Sindhwani, Program Manager India - Drishtee

Siddharth, working as the Program Manager for India, has a strong background in the development sector and extensive consulting experience. His profound commitment is driven by a desire to create a lasting impact on initiatives dedicated to social betterment.

Govinda Raut, Program Manager Nepal

Govinda Raut is a microfinance practitioner in Nepal and joined Kula Loans in 2023. His motivation for volunteering at Kula Loans is to create a significant positive impact on low-income people while utilizing his long-standing field experience in Nepal. He loves working innovatively.

Daniela Nemeti Baba, Co-Program Manager Nepal

Passionate about resilience building, community projects and Nepal, Daniela has joined team Nepal as buddy, providing support and learning about the Kula Loans community micro-financing method. She has a background in development, having worked with various grassroots NGOs. Currently, she works as sustainability consultant in ESG for the private sector and environmental and partnership building counselling for nonprofit organisations. She is passionate about trekking, outdoors living, permaculture and inner development, having completed several specialisations in permaculture design and various spiritual practices and therapies.

Ranko Tošković, Program Manager Gambia

Ranko started his Kula Loans journey as a Program Manager for Gambia. Driven by eagerness to make a contribution in the world of financial inclusion, he aspires to enable as many entrepreneurs as possible to realize their economic independence goal that would otherwise be hardly achievable. He brings his problem-solving skills, honed by years of experience in research in exact sciences and the world of strategy and data analytics consulting, boosted by his strong determination to put those skills to a meaningful use for the benefit of environment and societies, both current and future ones. Ranko is an amateur classical singer and spends most of his discretionary income on discovering new places and people across the world.

Nancy Ng’ang’a, Junior Program Manager Gambia

Nancy is passionate in empowering communities and was inspired by the diverse Kula Loans projects that empower poor communities in different parts of the world. She is currently pursuing her studies in Project Management. Ultimately, she hopes to utilize her passion and skills in community service and development in promoting change and poverty eradication in the target communities.

Our other volunteers support us with our online communication, content development, fundraising and other activities.

None of the board members or volunteers receive any salary or compensation for their efforts.

Our main partners are located in India and Colombia and we are planning to expand our partnerships to additional countries shortly.

Our (first) local partner is NEED, with several years of experiences in promoting value based economic cum social enterprises, and 15+ years of operations in education, skill training and value based fast growing non-farm & farm sector. NEED operates in Uttar Pradesh, Bihar, Uttarakhand and West Bengal (in the north of India), and covers over 6500 villages. Together we envision the poor people residing in the Northern region of India, to raise their standard of living, by empowering them to benefit from the solar power available to them, by investing in collectively owned solar-powered solutions, that increase the well-being of (the larger part of) their communities financially and environmentally sustainable manner.

NEED was founded in 1995 by Anil K. Singh, who started microfinance services in 2005, culminating in him founding NEED Livelihood microfinance in 2015. Anil has been selected for lifelong Ashoka Fellowship in 1998 (Ashoka Fellows are the world's leading social entrepreneurs. They champion innovative new ideas that transform society's systems, providing benefits for everyone and improving the lives of millions of people.)

Drishtee, is missioned to empower communities to achieve shared prosperity. They have a track record of decades of empowering marginalized rural villages by enabling them to create community-led and managed business ecosystems with need-based solutions that demonstrate scalable and sustainable models of growth. Drishtee operates mainly in Uttar Pradesh, Bihar and Assam in the northern parts of India, and covers over 6000 villages, in 17 states. Together we envision to raise their standard of living in the villages in North India, through investing in and supporting Swavlamban Micro-Enterprise Groups (MEGs) linked to each other in production chains spread across different villages, building a channel for the input-output supply chain that connects the community groups to the market.

Our partner Drishtee was co-founded by Satyan Mishra (currently MD) starting in 2000 as a technology solution providor in rural area's. Satyan was selected for lifelong Ashoka Fellowship in 2004 (Ashoka Fellows are the world's leading social entrepreneurs.) after which he was selected Schwab Social Entrepreneur of the year in 2005, WEF technology pioneer in 2007, and Unesco GAP partner for Education for Sustainable Development in 2016, to name just a few.

Our local partner Coimpactob, an accelerator of triple impact projects in rural communities in Colombia, committed to democratizing sustainable development and financial inclusion to communities in extreme poverty. With 5 years of experience facilitating education and impact entrepreneurship acceleration programs for youth and rural leaders and access to water, solar energy, and sanitation solutions.

Coimpactob operates in the Guajira, a desert region in northern Colombia, composed of indigenous Wayuu communities with difficult geographical conditions, poor infrastructure, lack of access to water, energy, food, and low investment by the government. In the last 3 years, Coimpactob has benefited more than 1000 indigenous families and 5 educational institutions with its acceleration, education, potable water, and solar energy programs with the active participation of more than 20 national and international partners.

We provide the revolving funds, and the technical assistance, to invest in community-owned technologies that will increase the well-being of the community. We started with solar-powered technologies in India. The funds provides credits for groups of people, to facilitate access to solar power technology, assistance to groups to set-up social enterprises to run/exploit those solar powered techniques.

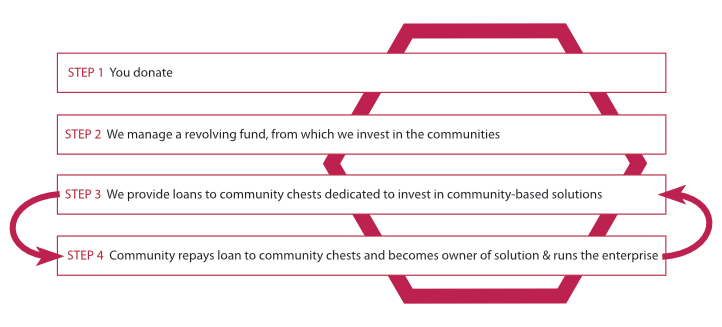

Kula applies a group loan and a community chest model, based on the belief that additional capital to the savings of a group of enterpreneurial people in remote or impoverished communities, enables the members of a group to invest in a group-owned solutions that will grow the wellbeing of the larger community.

"The community chest" is a community-owned and self-managed amount of (foreign) capital provided to the members who have pooled their own savings (and/or time investments). The foreign loan amount is pooled with their own (saved) capital and provides investment opportunities for the community as a whole, and to each of the members of the group/community. The Community chest is group-owned, managed by the members, and offers an opportunity for larger loans to the members -as a group- for various activities, at times they need it, for what they decide themselve they need.

The "group loan" is a model made as a step to grow towards a community chest. Groups of entrepreneurial people can take a group loan, to invest in a group-owned solution that will strengthen all of their income-generating activities. Mind you: they do not have to register as a legal entity for this, nor do they have to be(come) a cooperative for this. Think of a group of women who all produce pickled mangos and want to jointly invest in a packaging machine, that can be used by all members of their group, and others from their community. Or a solar-powered engine, shared by a group of farmers from the same village, to irrigate all of their fields.

Here is the assessment tool that we are currently using and improving, to assess the level of readyness of groups that apply for a group-loan or a community chest.

Download the Kula Loans Assessment tool community led group loan request.

In our partnership with NEED we envision the poor people residing in the Northern region of India, to raise their standard of living, by empowering them to benefit from this solar power available to them, by investing in community- as well as household owned solar-powered solutions, that increase the well-being of (the larger part) of the community in a (self-) sustainable manner.

In the Northern part of India, in the state of Uttar Pradesh, in the Lucknow district, in Gohramau village, in block Kakori, we provided a group-loan to the committee of the village community school, called Samiti. The group-loans was Euro 610, invested in a solar solution on the roof of the school, with which they power the lights, drinking water installation and fans.

On average such a school has around 150-250 girls coming. Girls pay a small fee, and the school committee used to pay electricity bills from the savings of the fees. However, electricity is very erratic, and costs are high. Some amount of their own savings, as well as the loan, are used to invest in the solar solution on the roof. Savings are directly from the cost they used to pay for electricity. The loan is repaid in monthly payments, and is expected to be paid back within 2 years time.

The community has taken the ownership of benefitting from the school for girls facility to the fullest. Not only the girls benefit from education, with lower cost due to savings of electricity bills. Also siblings benefit from play & day care facilities.

In our partnership with Drishtee we envision the growth of local economies in the most deprived Northern, North Eastern and Eastern regions of India, through group enterprises that not only generate income for the members, but also increase the well-being of the whole community. We will provide access to knowledge and capital, as well as support to bring the products to market. All the group enterprises we select and support, are connected in a production chain, lifting the local economy to the next level.

In Jansa village of Northern India, Anjana Singh and four of her village mates came together and set up a group owned and managed Micro-Enterprise. The group enterprise supplies fresh and pure Cow Milk to urban customers. Their goal is to become self-reliant as individuals and families and also as a business group. They started in August 2019 and are now gearing up for new product additions. Her income was an equivilant of USD 13, when she started. Currently the income of each group member is USD 25. So, a successful start of the group enterprise.

They have expressed an ambition to grow their business, from 1 product (milk) to 4 or 5 products, think of: cheese, ghee or curd. They anticipate to grow their income to USD 90 / group member. Worth an investment, no? Next to their income, they will grow self-belief, they will boost the village economy, as well as provide fresh and healthy products to urban consumers. A win-win-win.

In our alliance with Coimpactob we seek to strengthen local impact entrepreneurship that have participated in the acceleration programs and we have identified 2 entrepreneurship in the territory with recurring activities such as sheep breeding and tourism, which will receive training and access to community microcredits.

At the start of Kula Loans, we focussed on rural communities in the poorest districts of Uttar Pradesh and Bihar, the poorest and socio-economically most backward states in India, the second lowest in terms of a composite Human Development Index. Approximately 47% of the state population lives below the poverty line and, according World Bank estimates, 10% of the world's poor live in these states.

Ultimately, we aim to raise the standard of living of the communities in the countries we support through:

But...

There's something else to it too. Kula Loans is just a start - a pilot project so to say -. We want to start here, and share all our learnings, approaches and how-to's with others. With everybody who is interested to do the same, through our online global movement "Credits for Communities" (coming soon, stay tuned!). Because, if others follow suit, we can really scale impact and make a difference.

Each destination is reached by taking the first step. Do you dare to take it with us?

Kula Loans is a foundation managed by professionals, united by their passion to reduce poverty; They all provide their time, expertise and network for free, to assure that each donated euro will directly go to the communities we support.

We always work through local partners, either Non-Gouvernemental Organisations (NGO's) or Microfinance Institutions (MFI's) that have long established trust-based relations with the local communities. Our partners get their cost compensation from the interest the groups pay. We select our partners based on the following selection criteria:

Our 2022 annual report can be downloaded here (PDF format).

Download 2022 Annual report Kula Loans international

Our 2021 annual report can be downloaded here (PDF format).

Download 2021 Annual report Kula Loans international

Our 2020 annual report can be downloaded here (PDF format).

Download 2020 Annual report Kula Loans international

Our first financial year covers the period from October 2018 to 31 December 2019 and can be downloaded here (PDF format).

Download 2019 Annual report Kula Loans international

Kula Loans International has been granted the ANBI status (ANBI = "Algemeen Nut Beogende Instelling", a Dutch not-for-profit foundation aiming to create benefits for the society as a whole) on 10th of October 2018. Our registration number is: 859247302.

Currently we are looking for three things:

Donations are very welcome at:

Stichting Kula Loans International

IBAN: NL86 RABO 0334 5335 62

Bank Name: Rabobank Nederland

BIC: RABONL2UXXX

Country: The Netherlands (NL)

Alternatively you can use the geef.nl donation platform (supporting iDeal, bank transfer, credit card, paypal payment types) by pressing the folowing link:

CLICK TO DONATE AND SUPPORT KULA LOANS NOW!

or by scanning:

We now also support donations via Give for good.

We're thrilled to announce our partnership with Buzz Women Gambia! Jointly we will invest in female change agents to grow their community-based green ventures. By putting a Community Chest into the hands of groups of women entrepreneurs in impoverished communities, they are empowered to invest in village-based ventures that grows both the income of the members as well as the wellbeing if their village.

The Buzz Green learning capsule is focused on climate change and environmental education. The curriculum is built to engage, educate and empower women to serve as 'ecopreneurs' and start green businesses that contribute to climate mitigation.

The Kula Loans Community Chest is developed to support groups of enterprising people, and is based upon the existing social context, network and cohesion. Contrary to traditional lending methods, it's designed to ignite joint efforts by groups, instead of individual loan taking.

Take for example, Kerr Ardo, a community located in the Central Part of The Gambia. Ndogal Sowe, is selected by a group of 21 enterprising women, to represent the group. Jointly they have identified a green business to start with: seedling farming for different fruits. Parallel to that, they will start with poultry farming, based on the idea of using the waste of this poultry as compost production. Last but not least, they like to venture into organic Baobab fruit powder production. The Baobab tree being popular and easy to grow in this region. They can only use the fruit, leaving the trees themselves undamaged. For which they like to invest in a processing machine. The Community Chest can make their dreams come true!

2022 was a year of re-building our communities. The devastating consequences of corona, and the related lock-downs, in the past two years, brought us to revisit our programming. With the help of our families, friends and funders we have been able to support our local partners to deliver the requested investments -financially and educationally- to build back their own livelihoods, grow their own communities’ well- being.

For this we would like to thank our local partners. The local staff did everything in their power to go out and support the local communities to their needs. We can only have lots of respect for their relentless efforts.

Of course, we would like to thank all our sponsors and volunteers. Thank you for your trust, thank you for your flexibility, and thank you for all your efforts. We believe 2022 has brought back hope and resilience in the vulnerable communities.

For stories, our impact and how we do it, download our 2022 Annual report.

In 2021 & 2022 we have supported many groups of entrepreneurial women, with our partner in India, Drishtee, like Rupali Mahila Goot. The group is lead by Muksida Begum, based in Napan, Assam, and as a group theu invested in poulty. With 10 female entrepreneurs, they have built a hatchery, increasing their eggs and chicken production. The local value chain partners, those who bring the eggs to market, and the supplier of the food for the chickens, grow their income too. In 2023 we will of course continue to grow the number of these, so called Micro Enterprise Groups.

Next to growing the number of groups, we're super exited to deepen our impact too. In 2023 we will also move beyond the groups and invest in so called "community chests". We have selected communities with enterpreneurial groups (with income generating activities and healthy saving behaviour) and the will and decision processes in place to do what they feel is needed to grow the wellbeing of the larger community. We will support them with the additional funds, to add to the amount available to them, that comes from their own savings; with these funds from this community chest, they can decide themselves what to invest in, as long as it grows the community wellbeing. Some have chosen to invest in proper sports facility (for youth), others will invest in a health facility.

We're excited to see how this agency will ignite their power to self-develop and grow their wellbeing, as a community. More to come, stay tuned!

Donations for Kula Loans can now also be provided via Give for Good!

Give for Good helps donors support the future of a charity. Give for Good invests your donation and the charity receives interest on the investment every year. This interest continues forever and grows forever, making your donation an everlasting source of income for your favourite charity!

We're scaling into Colombia, with sustainable tourism in La Guaiira, as one of social ventures. Tardes Wayuu is a community and cultural tourism venture incubated by Coimpactob - a Bogota-based social impact accelerator. We're proud we've forged a strategic partnership with Coimpactob!

Supported by Coimpactob, six entrepreneurs from the Wayuu indigenous communities will offer ethnotourism experiences for national and international tourists and companies. The Kula group-loan will be invested in infrastructure, think of: energy, sanitation and utensils for the dining rooms. Good to know: 98% of the Wayuu indigenous communities do not have access to electricity, water, and sanitation. So, we're thrilled we can support to grow towards a sustainable future of this community. Stay tuned, for more communities to be supported.

Kula Loans International

Leidseweg 77bis

3531 BE Utrecht

The Netherlands

Please use our contact form or any of the social media below to contact us!

We will respond as soon as possible.